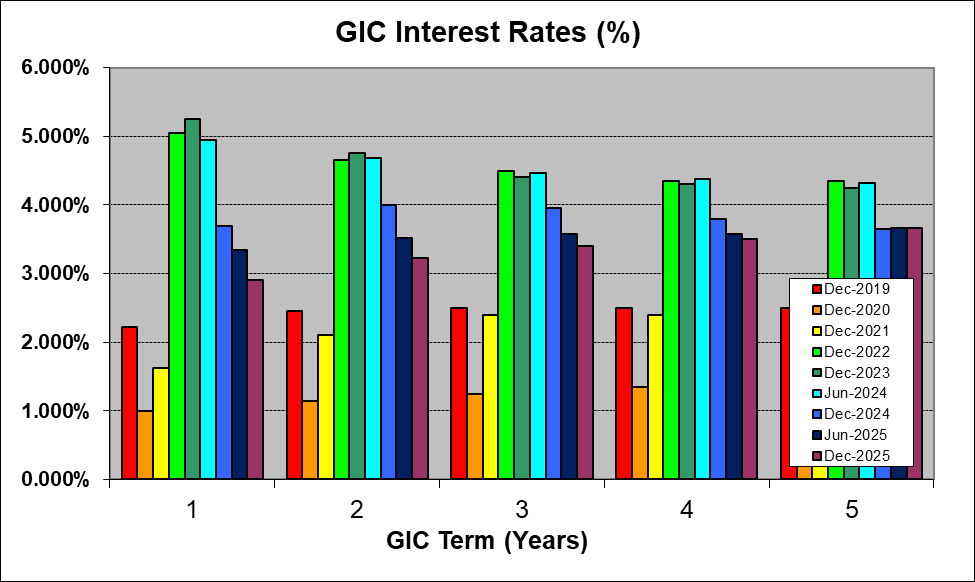

GIC rates are a reflection of the short end of the bond yield curve, and that curve has now normalized, with short term rates having dropped lower than long term rates. We don’t expect further cuts to interest rates unless inflation or unemployment increase materially.

In the summer of 2024, 1-year GIC rates were near 5% – higher than 5-year rates – but ended 2025 just under 3%. 1-year rates generally followed the cuts to the Bank of Canada Rate, while 5-year GIC rates have remained steady despite the cuts to short rates.

Source: Dataphile via Cannex

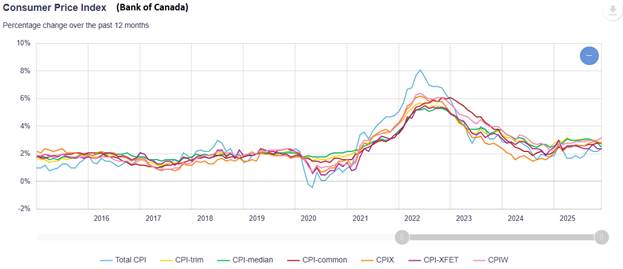

The Bank of Canada began 2025 with the Bank Rate at 3.5% after a historically unprecedented rise from near-zero COVID-era rates in 2022 and 2023. Rates had been allowed to settle back toward the 20-year average during 2024, and the Bank made 4 further cuts of 0.25% each during 2025, as inflation has remained in the 1-3% target band and unemployment has remained steady.

Source: Bank of Canada https://www.bankofcanada.ca

Inflation had spiked due to pandemic-related supply chain disruptions and a surge in demand after economies re-opened in 2021. Some believe central banks should not have kept rates so low for so long, and the low rates may have contributed to the inflation surge. The large interest rate increases of 2022 had immediate effect in dampening the inflation rate, though prices had been lifted significantly during the high inflation years, and are unlikely to decline back to earlier levels. At least the annual inflation rate is within the 1-3% target range and not much higher than it was 10 years ago.

Source: Bank of Canada https://www.bankofcanada.ca

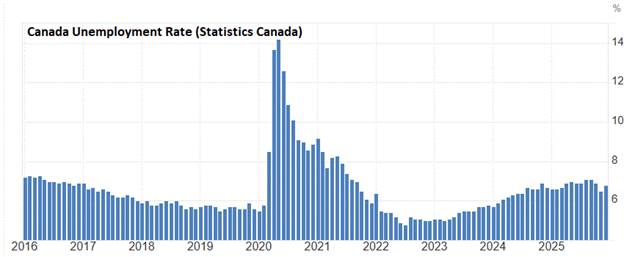

Unemployment had been rising from post-COVID lows since the interest rate hikes began in 2022, but seems to have peaked by the fall of 2025. While unemployment remains a bit higher than ideal, it is lower than it was 10 years ago.

Source: Statistics Canada https://www.statcan.gc.ca

We believe the Bank Rate is at a new equilibrium level, and that the Bank is unlikely to cut further unless inflation or unemployment take significant rises.