2022 was a brutal year for investors in almost every asset class. It could best be described as a pandemic-induced aftershock with the price pressure of re-opening in-person commerce in the face of still-strained supply chains, and a return to positive interest rates to offset the inflationary effects of record fiscal and monetary pandemic stimulus. Russia’s war on Ukraine added to the pain, disrupting energy and food market supplies and sending prices soaring, while central banks increased interest rates at a pace never before seen, in an attempt to control all the resulting inflation and excess demand for labour.

Fortunately, the aftershock is passing: most of the damage to asset markets was done in the first half of 2022. Since then, volatility has remained high, though in a narrower range, and despite new lows in October, most benchmarks recovered nicely in the second half of the year. That trend has continued in the first half of January, but still leaves calendar 2022 as one of the worst years on record for both stock and bond investors. Home prices are still declining as the effect of the interest rate increases takes time to be fully felt, but more liquid markets for stocks and bonds have likely priced them in already. Investors should take some consolation from the fact that all major equity market benchmarks are up over a 2 year period, except Germany, Japan and Emerging Markets (those most impacted by the Ukraine conflict), with stock price multiples much lower and bond yields much higher than before the pandemic – a much safer setup for the next growth phase.

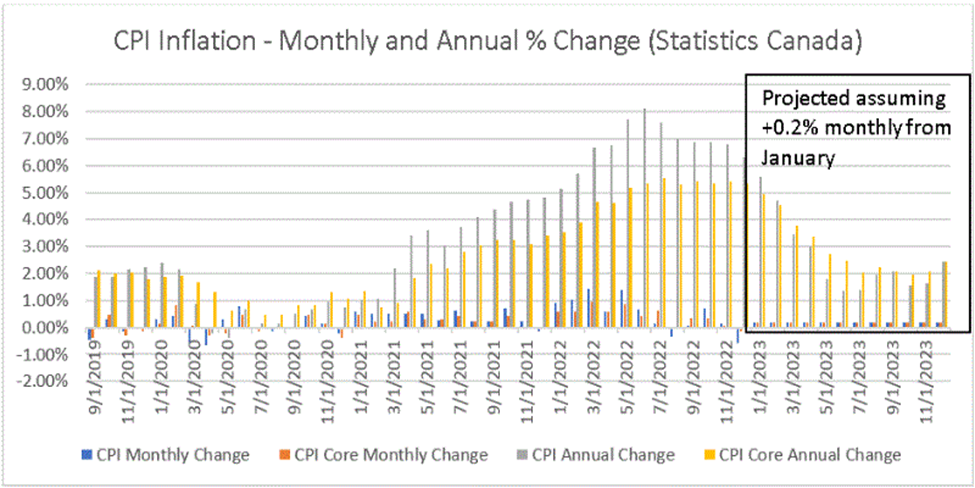

The interest rate increases are they key macro-economic impact that pushed down all asset prices in 2022, even comparatively safe bonds and real estate. In hindsight, we would have expected some increase in interest rates from the pandemic-era historic lows (close to zero) but nobody in 2021 was expecting the size of those increases and how quickly they were applied. Fortunately, those rate increases are widely expected to be coming to an end in the first half of 2023 as the past year’s inflation shocks age out of the year-over-year headline figure. That headline consumer price index (CPI) rate of change peaked at 8.1% annual rate in June, then month-over-month inflation essentially stalled, and by December the annual rate had already drifted down to end the year up 6.5%. While this is still an uncomfortably high rate, it is almost certain to slip dramatically in the coming months: even if the month-over-month rate rises to 0.2%, the annual rate would be back within the 1-3% target band by May 2023, though most economists think it could take longer.

Markets have likely priced in one more rate hike in Canada in January, after which many believe the Bank of Canada may pause to see if the effects of their prior hikes continue to have impact (it usually takes 12-18 months to have full effect, and it has been only 12 months since the first hike). Once inflation is back in the target range for a few months, we would expect interest rates to gradually decrease back to their average levels of 3-4% consistent with a 2% inflation background. Markets should then surge higher.

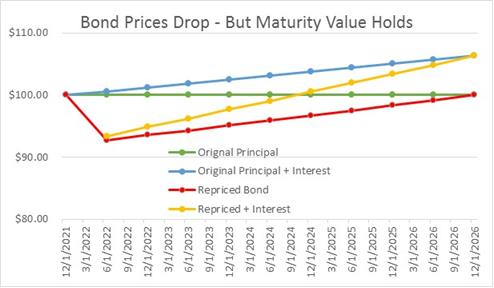

Unfortunately, the high interest rates will probably cause a recession in early to mid-2023. The market seems split between those who expect this to be a mild and short-lived recession (ie Soft Landing) and those who worry it could be worse. Markets will have priced in the balance of these expectations. A deeper recession could send stock indices lower, but would also send inflation lower, bringing closer the first interest rate cut. Historically, markets have started their next growth phase before the end of recessions (markets look forward, not backward), and if history is any guide, we will look back on late 2022 and early 2023 as a good time to add to long term assets like funds that contain stocks or bonds. If interest rates are near a peak, bonds are a pretty safe bet (2-year government bond yield is currently close to 5%, but this probably won’t last: 5-year bonds pay less, telling you the market doesn’t think rates will stay this high for long). A drop in rates would be stimulative to market growth just as rate hikes hurt in 2022, and there is still a record amount of cash in consumers’ accounts that can be deployed to sustain a rally once it starts. Meanwhile, the volatility is expected to continue until central banks pause their rate-hiking cycle.

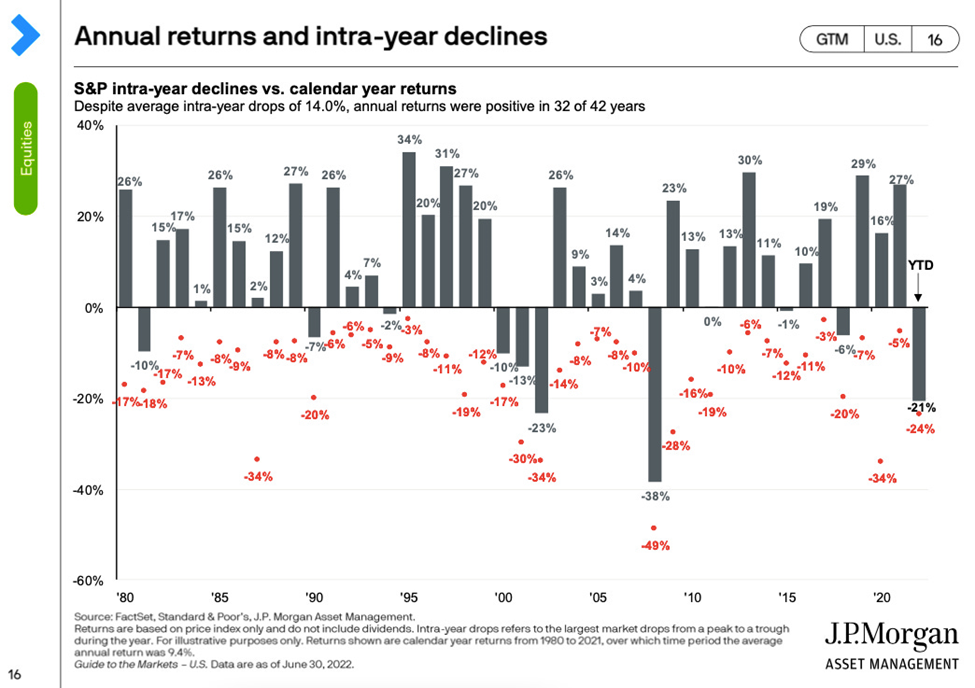

We hope you will take some comfort in knowing that since 1980, the S&P500 index of US stocks gained value in 33 of the 43 years, and even the gaining years contained an average -11.7% ‘drawdown’, or decline from market peak to its next low, in this insightful chart from Sam Ro:

(Source: My favorite visualization of short-term stock market performance 📊 (tker.co)).

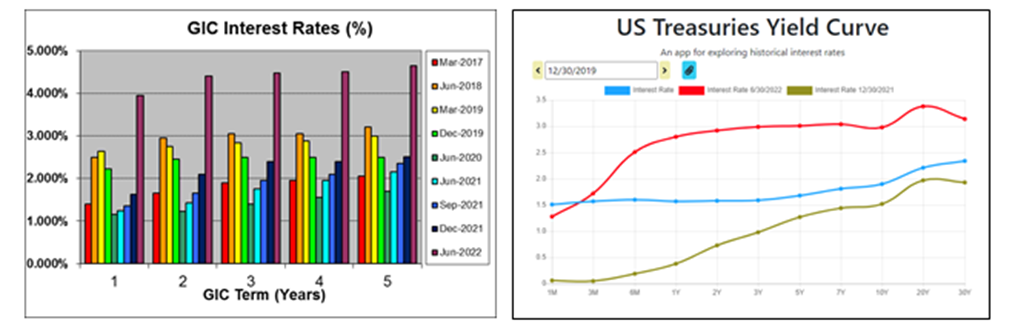

2022 was one of the worst in recent memory, but we rarely get two negative years in a row – one exception being the tech-bubble collapse in 2000 followed by 9/11 the year after. With about one losing year in every 4, a 5-year average would be a more reasonable basis to compare returns between asset classes, but even a 3-year return looks reasonable looking back from the end of 2022: in Jan 2020 our top rate for a 3-year GIC was only 2.5% annual interest. Over the same 3-year period as that GIC, by Dec 2022 you would have averaged 5.54% in the S&P-TSX, 7.18% in the S&P500, or 0.29% in the MSCI EAFE net after expenses (see our Index Return Table 2022Dec31) Since you can’t invest directly in the index, we assume 2% expenses on a managed portfolio that invests in the same market, and have reduced the index total return by that cost to get the figures noted above). A growth portfolio including all three of these markets plus some bond funds would have netted only 2.33% in the same period, but averaged over 6% over the past 10 years. (see our Growth Portfolio Benchmarks calculation here Portfolio Benchmarks 2022Dec31).

As always, a balanced approach to investing, with adequate cash reserves, some fixed income (bonds or GICs) for stability, and a diversified equity portfolio for long term growth and inflation protection, will support cash flow goals while delivering after-tax returns well above inflation over the medium term.

Please call us if you would like to review your portfolio in the context of your goals.