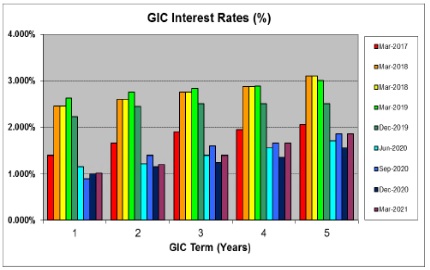

2022 was the worst year for bond investors since 1990, the last time interest rates spiked significantly in a short period of time. Many investors may be tempted to sell their bond fund holdings after such a bad year, but that would likely not be prudent. The below article from TD Investment Management notes that yields on bond portfolios have risen as central bank and GIC rates have increased, so bond investors are now earning close to 5% interest compared with the 1-2% they would have expected a year ago, and will recover last year’s losses as the bonds in their fund return to their Par value as they get closer to maturity. Bonds or GICs continue to play an important defensive role in a well-diversified portfolio, offsetting the higher volatility of stocks and other equities.

Click here to read: Bailing on Bonds? Why now is not the time