2025 Mar 4

If you’ve been watching the news the past couple of months, you’re probably already tired of hearing the word Tariff. They have been threatened since before the US election last November, and now that US Import Tariffs against Canada and Mexico have actually taken effect, asset markets are reflecting the drag these measures will have against economic growth and employment in all three countries.

Canada’s counter-tariffs were implemented the same day as the US tariffs against us, and Ontario’s Export Duty will soon apply to electricity exports to the US (penalizing US voters while raising revenue in Canada). Further actions should be expected from each party, and markets will be volatile. If the tariffs remain in place for an extended period, this will likely cause a mild recession in Canada (per BMO today), while Canada lines up other export markets. The Bank of Canada may be more inclined to cut rates again next week as a defensive measure.

The question now is how long the tariffs remain in place and what level they settle at. I believe that before long, all parties will agree that tariffs are not the best policy option, and some variation of NAFTA/USMCA will be worked out. In most cases tariffs are essentially a tax on consumers that shields local production from full competition, while consumers are better off on balance to import goods when it is less costly to do so, provided that the producer is operating in accordance with fair production practices and maintains a reasonable trade balance. Trade agreements are the tool generally used to balance these interests.

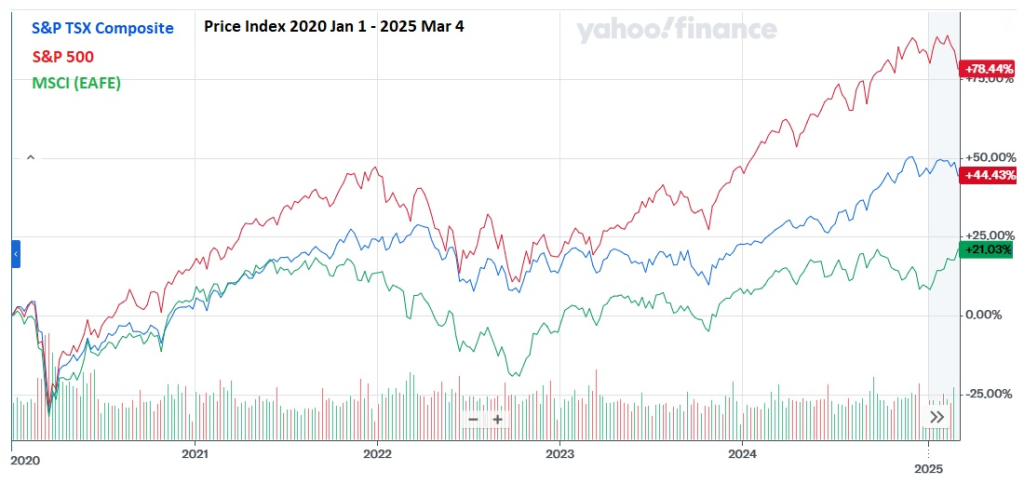

Since the US election November 5th, North American markets have surged and retreated several times in about a 5% range, partly on policy uncertainty. Today was the second trading day since the tariffs were confirmed on Monday, showing about a 4% decline since the most recent peak Feb 19, now back to the January 10-13 lows, but still above election day values. Meanwhile, the MSCI (EAFE) index of developed countries outside North America is up over 10% since its Jan 13 low, up about 4.5% since election day – international diversification usually stabilizes portfolios overall.

If you have a long time horizon for your investments, short term geopolitical conflicts should not cause a change in overall strategy. History usually shows such events as mere blips when looking back 5 or 10 years. We select fund managers with a solid track record who can make adjustments to their stock and bond holdings on your behalf as they navigate through such disruptions. This too shall pass.

Major market indices since Jan 2020