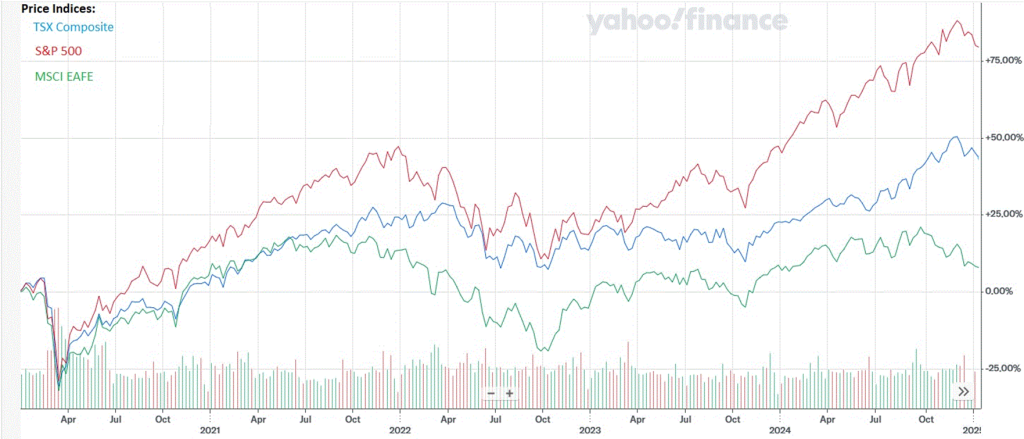

Equity markets in North America posted stellar returns in 2024 on the heels of a terrible 2022 and the start of a recovery in 2023. International markets went along for the ride until October, when they started to lose most of the year’s gains in the third quarter. North American markets peaked at the start of December, and gave back some gains, ending the year around October levels.

Declining central bank interest rates in 2024 have pulled down short term bond yields, but longer bonds still yield over 3.5% for Canadian 10-year bonds, and over 4.5% in the US. Recent strength in US GDP and employment statistics have decreased market expectations for further rate cuts south of the border. In Canada, economic statistics are weaker, and we may expect some further rate cuts here. International markets continue to feel the weight of conflicts in Ukraine and the middle east, as well as uncertainty over US trade policy.

(Source: tradingeconomics.com)