The past trading week went down as the worst week for the TSX since March 2020. The S&P500 benchmark officially ended down 20% from its prior peak in December as the US Federal Reserve hiked its key overnight rate by 0.75% for the first time since 1994. And the media is stoking fears of further declines and possible recession. It is times like these that emotions take over and has investors asking “should we sell to avoid further declines?”

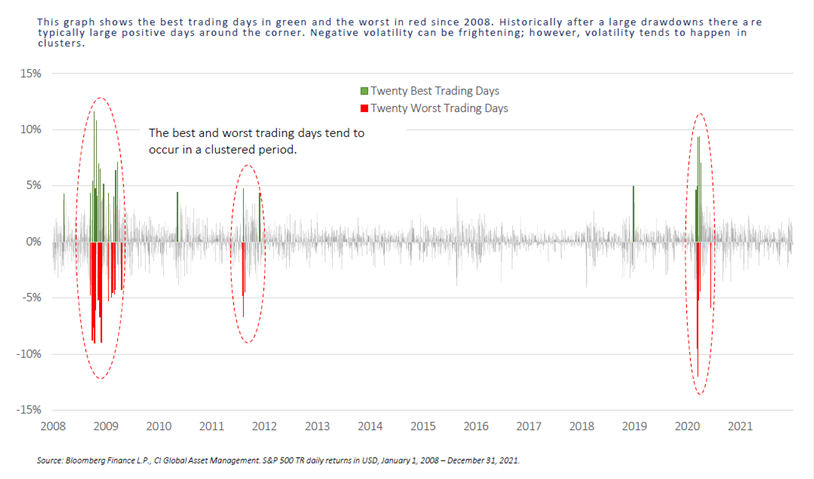

What we do know from history is that the best market days are clustered in with the worst market days and being out of the market for these best days significantly impacts long term returns.

Source: https://ci-arena.ci.com/od/bb0dfeb6

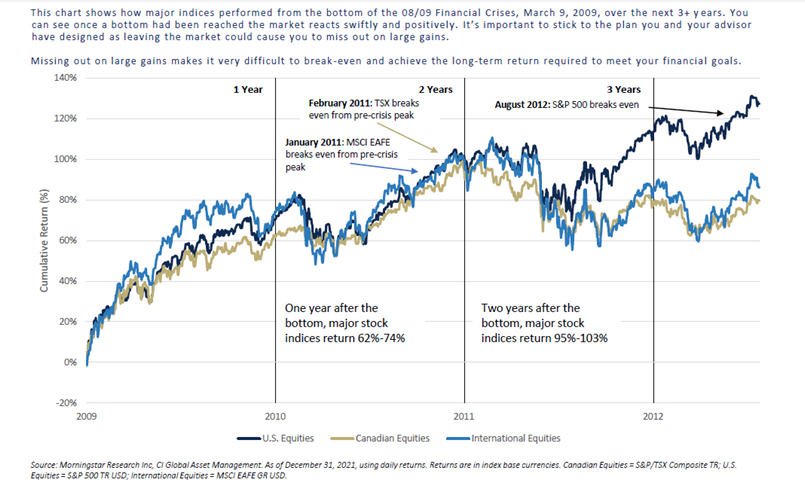

Also, most stock market gains happen shortly after a bear market. Even after the 2008 Great Financial Crisis, most major benchmarks had regained their prior highs in 2 – 3 years.

Source: https://ci-arena.ci.com/od/48cf0671

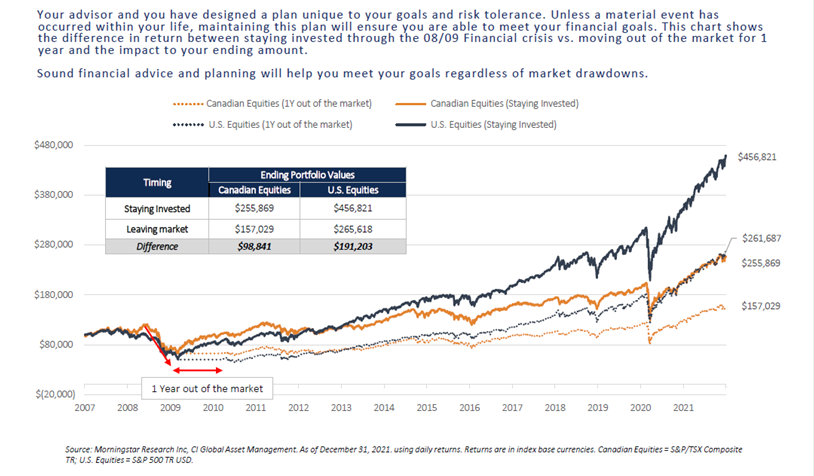

Investors who exit the market during a bear market risk missing this rebound. Missing even 12 months of the post-2008 recovery would have significantly reduced their returns over the next 12 years.

Source: https://ci-arena.ci.com/od/fea210a9

It is important during periods of volatility to stick to the plan you created with your advisor. This plan incorporates your long term financial goals along with your near term cash flow needs and risk assessment, and will help you through this market as it has done for many investors in the past.

You can call us anytime to review your objectives and make sure your portfolio allocation is appropriate and consists of high quality portfolio managers.