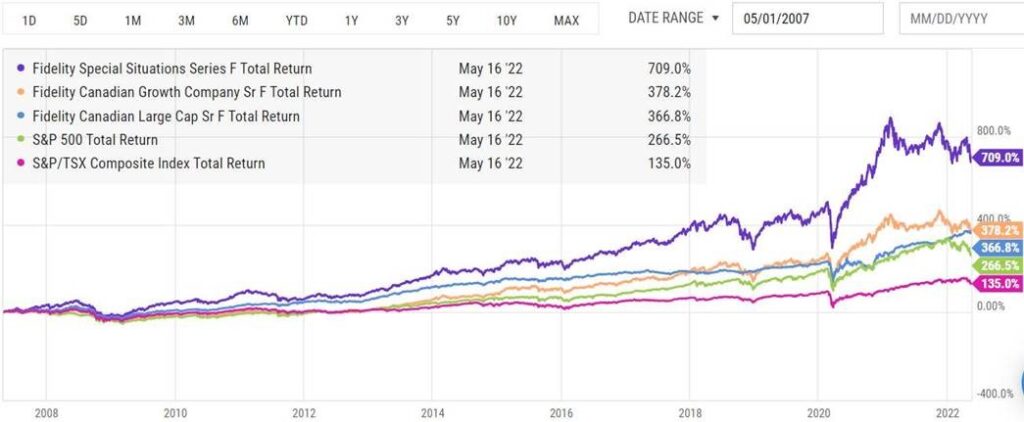

The below chart highlights the returns from May 1st, 2007 until yesterday’s close – a period of roughly 15 Years. This includes the Global Financial Crisis, the COVID-19 Pandemic, and countless corrections/world events in between.

We’ve shown the returns of 3 of Fidelity’s flagship equity strategies against the S&P 500 and TSX over that time period. Their returns against the indices have been staggering and serve as a reminder that not all active managers are created equal. We believe that Portfolio Managers Mark Schmehl and Dan Dupont have proven themselves as the “elite of the elite”, which is why they have been on our preferred managers list for some years already.

Volatility is part of investing; perhaps some investors have forgotten that over the past 3 years. Rather than trying to figure out when/how it will end — use downturns as an opportunity to add/diversify for clients with the appropriate time horizon and stick to your investing principles. Patience is the ultimate path to success.

15 Years of Returns: Fidelity Special Situations, Canadian Growth Company, and Canadian Large Cap