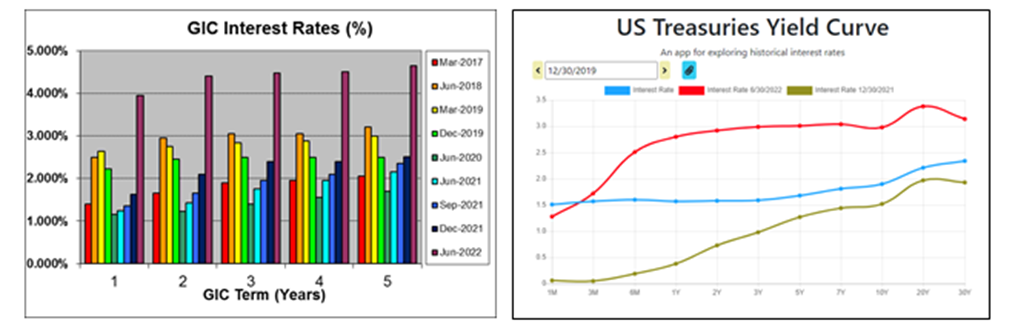

With surging central bank rates and bond yields, GIC interest rates have also risen sharply this year, with top offers on 1-year terms now paying almost 4%, and 5-year terms over 4.5%. These are the highest GIC rates we’ve seen since before the 2008 Global Financial Crisis (Source: Cannex Financial Exchanges).

Bond yields spiked earlier this year on expectations that central banks would hike rates in response to building inflation pressures. The chart top right compares bond yields of all terms before the pandemic in blue, December 2021 in green, and June 2022 in red – quite the surge in a short time, especially in the shorter terms (Source: www.ustreasuryyieldcurve.com).

Top GIC rates are usually higher than government bond yields of the same term because of two risks: one is that you can’t redeem or sell a GIC before it matures, the other is that the bank issuing the GIC could fail. Investors control the locked-in risk by staggering GIC maturity dates and by maintaining some liquid cash deposits in case some cash is needed between maturity dates. They can also control the default risk by only working with institutions that are deposit-insured.

Because you can’t sell GICs before they mature, their reported current values are always based on the guaranteed principal plus any interest accrued, thereby masking the impact of rising market rates. You might be sad your interest rate is lower than currently available, but can be glad you won’t see any decline in value on your statement.

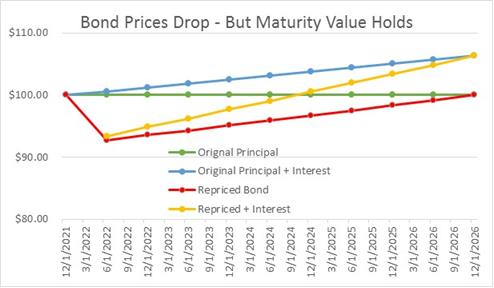

Because bonds can be sold in the market before they mature, their market values will drop when market yields increase. However, just like GICs, bonds will still mature at their full principal value, so investors who hold onto them after a decline will still earn the same yield they had expected when they bought them. In the graph below, we show a 5 year bond bought December 31 2021 at the then-current 1.27% yield, which would be worth about $106.50 with accumulated interest when it matures December 31 2026. By June 30 2022, market yields for a 4.5 year bond had risen to 3.00% implying about a 7% reduction in the value of the original bond to keep its yield aligned with the higher market yield. In the graph below you can see that as time passes and the maturity date gets closer, the market value of the original bond would gradually recover to 100% of its principal value, plus the investor would have all of the interest expected originally. The investor actually has an advantage since the interest payments can now be reinvested at higher rates than initially expected.

Once the market value has dropped in response to higher market yields, the effective return to maturity will be in line with the market yield, so there is no advantage to be had trading out after yields have already increased. In this case you would be sad that your market value has declined, but you might be glad that your yield to maturity is now much higher.

If market yields moderate again once inflation is back on target, bond prices should recover. If you are not keen on such fluctuations in the defensive sections of your portfolio, perhaps a series of GICs with staggered maturities would be a better fit.